Where to Store Gold and Bitcoin Overseas

Panama, Singapore, Switzerland

With the U.S. banking system beginning to report significant losses and the looming possibility of what appears to be a second great financial crisis, it's essential to address the topic of precious metals and their secure storage. Prior to the emergence of Bitcoin, I had been saving my wealth in precious metals for years, viewing them as a reliable store of value and insurance in case the financial system experienced a meltdown. The only trustworthy way to own precious metals is through physical possession because gold mining stocks and paper derivatives are likely to become worthless in a genuine crisis, precisely when these assets are most valuable. Given the U.S. government's history of gold confiscation in 1933 through Executive Order 6102, the question arises: Where should one safeguard their gold?

Let's begin with where not to store your gold. Bank safety deposit boxes should be avoided, as they are likely to be the first place government authorities search. Once you deposit money in a bank, it essentially becomes the property of the bank, and in an emergency, relying on the bank to grant you access may not be ideal. While gold depositories offer a better option than bank safety deposit boxes, if they are located in the U.S., they are still susceptible to government intervention, potentially resulting in nationalization of gold assets and compensation in fiat currency, which may only be a fraction of its true value. If I were residing in the U.S. or Canada, I would recommend keeping a small portion of your holdings in a secure safe at your primary residence, ensuring easy access in case of an emergency. The bulk of your precious metals, however, should be stored in an overseas vault for added security and peace of mind.

Where to Store Overseas

When storing gold overseas, it is advisable to steer clear of both Western nations and unstable nations. Currently, the top three countries for storing precious metals that satisfy all my criteria are Switzerland, Panama, and Singapore. All three of these nations boast appropriate storage facilities, stability, confidentiality, and robust property rights laws. While no jurisdiction is foolproof, if you possess a substantial amount of precious metals, you might want to consider diversifying and distributing them across these three regions.

Panama

Fort Kobbe International Vaults offers a premium asset storage and wealth preservation service for discerning investors in Panama City, Panama. The name is derived from the former U.S. military base, Fort Kobbe, which guarded the Panama Canal. Although the base is no longer operational, the U.S. military is still responsible for protecting the Panama Canal Zone, where Fort Kobbe International is located, in the event of any obstruction to the free flow of traffic through the canal. Fort Kobbe Vaults is located in a major industrial complex hosting international companies, which is under armed guard and requires passing through a guard gate to access the building.

Fort Kobbe is a highly professional and well-run service. To become a client, you will need to pass a background check and an in-person interview with the owners. However, you can mention the Bitcoin Capitalist as a referral when establishing an account. Fort Kobbe offers competitive pricing for safety deposit boxes in varying sizes to suit your needs. These boxes can be used to store precious metals, documents, and Bitcoin backup codes and seed phrases. Firearms and illicit products are not permitted, and they will observe you interacting with your box.

To get your gold into Panama, you have two options. Fort Kobbe has partnered with two American precious metals dealers, Scottsdale Mint and Kitco. You can buy directly from these companies with your credit card, and every two weeks, your precious metals order will be bundled with other clients for a wholesale shipping rate and shipped directly to Fort Kobbe vaults. Your metals will be placed inside their massive vault, which is incredibly secure and reminiscent of something out of a James Bond movie. Your assets will remain there until the next time you visit, at which point you can pick them up and place them into your safety deposit box. Alternatively, you can purchase precious metals directly from Fort Kobbe Vaults, which also offers liquidity, allowing you to convert your metals back into dollars.

As someone who has traveled throughout Latin America, I can attest that there is no other facility like Fort Kobbe in operation. Many of the countries where I have residency do not have any vault storage, and the few safety box facilities in Panama simply do not compare to what Fort Kobbe has to offer. It's truly a top-of-the-line service for safeguarding your assets.

Tour

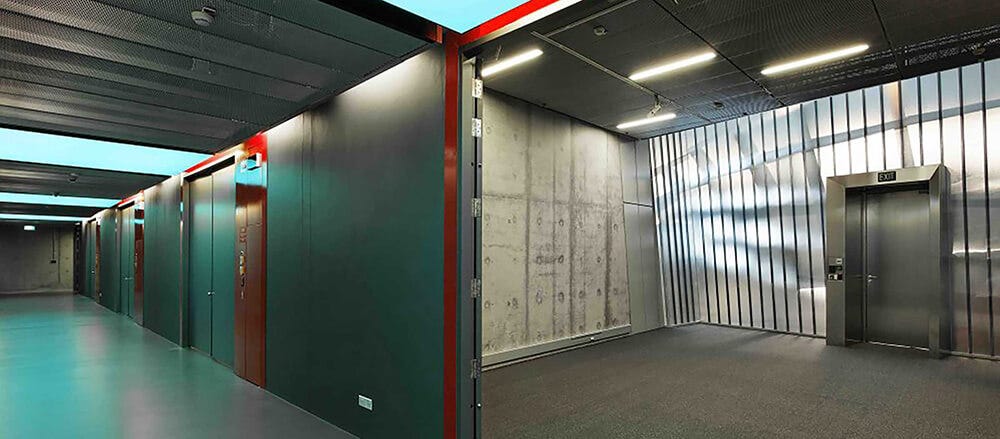

Due to insurance reasons, I was unable to take pictures of the main vault. The vault door you see in the pictures below is meant for the safety deposit boxes. There is no other precious metals storage facility in Panama, let alone in Latin America, of this caliber.

Info:

Fort Kobbe International Website

Phone - +507 310 0935

Email - info@fkmpa.com

Address - Building 9080, PanAmerican Corporate Center, Panamá, Panama

Partnered U.S. Precious Metals Dealers:

Singapore

As of the present moment, Singapore holds the top position globally as the prime location for gold storage. The nation of Singapore stands out as one of the best-administered countries in the world, boasting robust property rights and protections. The Singaporean government is steadfast in its commitment to this asset class and has consistently acquired substantial amounts of gold for its central bank, setting new records in the process.

Where to store:

Singapore Precious Metals Exchange

Switzerland

Switzerland stands out as the foremost and globally renowned hub for banking and gold storage. It has earned the trust of the global elite, primarily due to its stringent banking secrecy laws and a steadfast commitment to neutrality during significant global conflicts. Additionally, Switzerland holds a prominent position as one of the world's largest gold refiners, ensuring a secure and readily accessible market for purchasing precious metals within the country, followed by safe and reliable storage options.

Where to store:

Bitcoin Capitalist Telegram group

Bitcoin Capitalist WhatsApp Group