TowerBank: Your Bridge to Crypto-Friendly Banking in Latin America

Seamlessly Connect Your Crypto Assets to the Traditional Financial System

Introduction: When news broke that TowerBank in Panama City, Panama, would become the first crypto-friendly bank in Latin America, accepting USDT deposits and soon expanding to include Bitcoin deposits, I knew I had to personally experience the process and share it with my followers. TowerBank's acceptance of cryptocurrencies is a significant milestone due to its integration into the swift system, allowing for the conversion of USDT into dollars and seamless transfers to other banks within the international financial network. In essence, TowerBank serves as one of the few access points connecting the crypto world to the traditional financial system. Established in 1971, TowerBank is a privately owned institution and one of the prominent banks in Panama. Unlike smaller banks, TowerBank's reputation and size make it a trustworthy choice for those venturing into the world of crypto banking. In this article, I will provide a detailed account of my experience setting up an account, along with the pros and cons of having a crypto-friendly bank account.

Account Setup Process: TowerBank has multiple branches across Panama, but for a hassle-free account setup, I recommend visiting their main branch, TowerBank Casa Matriz, identifiable by the large building bearing their name. On my first visit, I arrived without an appointment and managed to meet with a manager within approximately ten minutes. However, I highly recommend scheduling an appointment in advance, as the bank can get quite busy. When meeting with the TowerBank manager, I expressed my interest in opening a personal crypto bank account, noting that TowerBank also provides business crypto accounts. To initiate the account setup, I was required to submit essential documents such as my Cedula (National I.D.), Passport, Tax Returns, and proof of income. The amount of dollars you can deposit at the bank is determined based on your proof of income and monthly earnings. Once the documents were verified, I provided the TowerBank manager with my USDT ERC20 address, which they also verified. It is important to note that TowerBank exclusively handles ERC20 USDT transactions, not TRC20 USDT. The entire account setup process took approximately one hour. Upon completion, I was instructed to return the next day to collect my debit card. TowerBank also offers credit cards; however, a deposit of 10k is required to obtain a 5k credit limit, aligning with the industry standard.

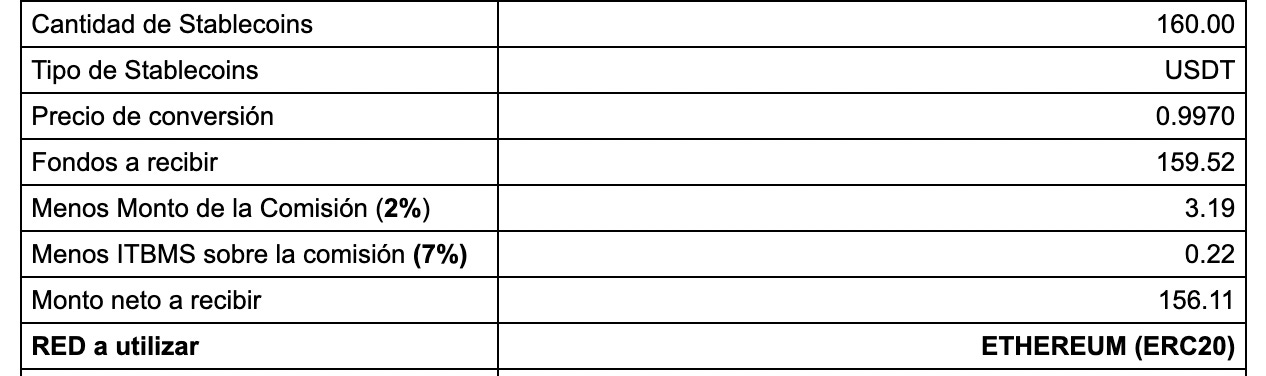

The Debit Card and Conversion Process: Upon my return to the bank the following day, I received my debit card directly from the manager. Excited to test the dollar-to-USDT conversion, I made a deposit into my account at the bank counter. After the deposit, I proceeded to download the TowerBank app and searched for the option to convert my dollars into USDT. To my surprise, such an option was not available within the app. Instead, the conversion process involves sending an email from your registered email address to the manager, specifying the desired conversion amount and providing your dedicated USDT address. Once received, the manager responds with a confirmation email, including all the necessary transaction details and fees, which you must confirm. TowerBank charges a competitive 2% conversion fee for converting between dollars and crypto, solidifying its position as the sole legitimate bank offering this service. However, it is worth noting that TowerBank is actively developing a new app and website that will allow users to automatically convert in and out of crypto on their platform, a promising game-changer. Although the back-and-forth emails for crypto conversion can be slightly cumbersome, the opportunity to integrate crypto into the traditional financial system makes it well worth the effort.

Conclusion: Opening an account with TowerBank turned out to be more straightforward than I initially expected. The convenience of having a crypto-friendly bank account at TowerBank enables seamless transitions of funds between cryptocurrencies and the traditional financial system. While the current email-based conversion process may present some challenges, TowerBank's competitive conversion fees and their forthcoming app and website updates highlight their commitment to enhancing the user experience. TowerBank's longstanding presence and reputation in Panama position it as a reputable institution, playing a significant role in the emerging crypto banking landscape.