Bitcoin Miner Profitability

Return on Investment

The two most significant factors influencing Bitcoin profitability are obtaining inexpensive energy and securing Bitcoin miners. Bitcoin Capitalist has successfully addressed both of these challenges by engaging in Bitcoin mining operations in Paraguay. This country boasts some of the world's most affordable energy prices, thanks to the presence of the Itaipu Hydroelectric dam, which is the third-largest in the world. Furthermore, Bitcoin Capitalist has achieved favorable pricing on Bitcoin miners by directly sourcing them from China

Machine Costs

Note: Bitcoin miners are priced like a commodity they fluctuate with the Price of Bitcoin.

Quantity 10 - Antminer S19J Pro + 120TH 3300w Bitcoin Miner - Price $1,685.00

Shipping & Taxes depend on final destination

10 Unit Total - $16,850

Mining Costs

$0.06 kWh Energy Cost

7% of Bitcoin mined for management and maintenance

Miner Profitability

Bitcoin 50k Estimate - Antminer S19J Pro + 120TH 3300w Bitcoin Miner

Daily Revenue $11.66

Daily Electricity Cost $4.75

Daily Maintenance fee $0.01

Daily Profit - $6.90

Monthly Profit $207.10

Yearly Profit $2,519.68

Return on Investment

Machine Cost $1,685

Shipping Estimate $220

Tax Estimate 10% - $169

Total Cost - $2,074

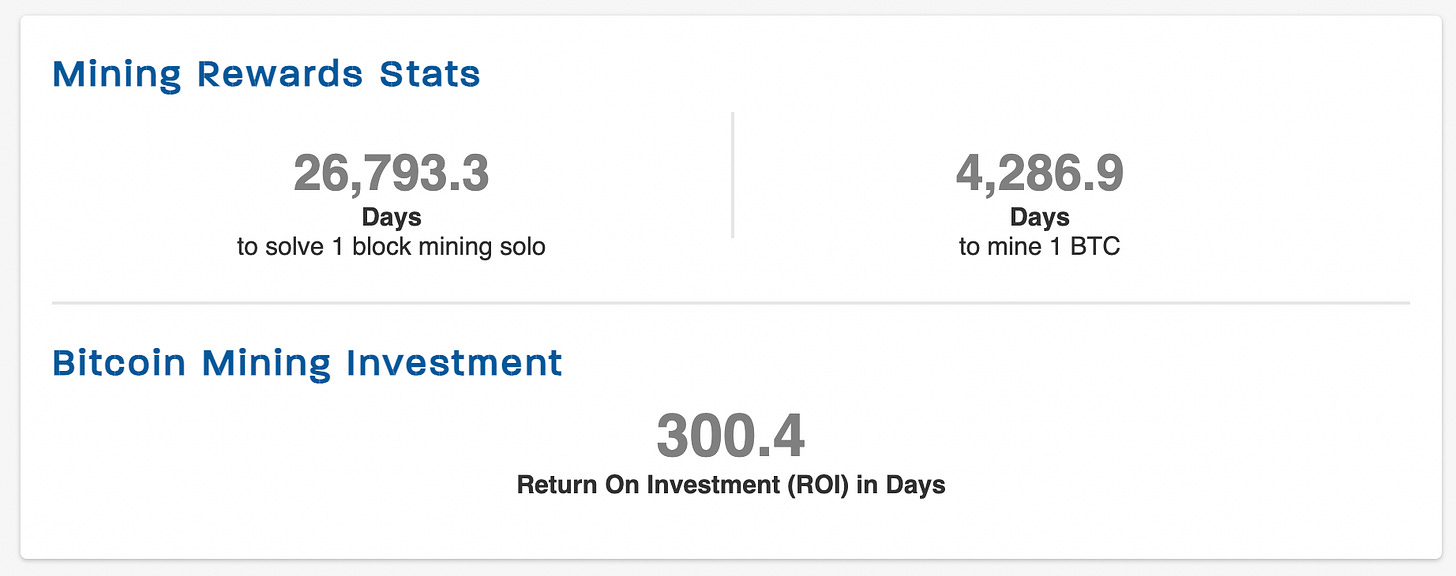

Return on investment in days 300.4

You can calculate Bitcoin miner profitability on the website CoinWars. Click on 'Advanced Settings,' and you can experiment with different scenarios to see the mining profitability of Bitcoin at $100,000 and beyond.

How long do Bitcoin Miners Last?

The standard lifespan of an ASIC miner typically falls within the range of 5 to 7 years. However, with appropriate care and ideal conditions, the latest models have demonstrated the potential to endure for up to a decade. It's important to note that the actual lifespan may vary depending on factors like usage intensity, maintenance practices, and the environmental conditions in which the miner operates.

Conclusion

If you anticipate a continued rise in Bitcoin prices and are willing to commit to purchasing miners during a market downturn, I believe that Bitcoin mining could prove to be a highly profitable venture. It offers a robust source of passive income while simultaneously contributing to the security of the network. Waiting to invest may result in a diminishing return on investment, as machine prices tend to rise in tandem with Bitcoin prices, and availability dwindles during bullish markets.

Moreover, it's essential to consider the burgeoning Bitcoin mining industry in Paraguay. Rising energy costs and regulatory constraints in Western countries have fueled a mining boom in Paraguay. Given the current scenario, Bitcoin mines in the region are operating at full capacity, with limited hosting space available. The construction of new mines takes time, contributing to the scarcity of hosting opportunities. If you aim to secure affordable miners, lock in advantageous energy rates, and guarantee hosting space for your machines, I would recommend taking action within the next 90 days before the market becomes increasingly competitive.